|

Real gross domestic product -- the output of goods and services produced by labor and property

located in the United States -- increased at an annual rate of 1.9 percent in the first quarter of 2012 (that

is, from the fourth quarter to the first quarter), according to the "second" estimate released by the Bureau

of Economic Analysis. In the fourth quarter of 2011, real GDP increased 3.0 percent.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.2 percent. The increase in real GDP in the first quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, residential fixed investment, private inventory investment, and nonresidential fixed investment that were partly offset by negative contributions from federal government spending and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased. The deceleration in real GDP in the first quarter primarily reflected a deceleration in private inventory investment, an acceleration in imports, and a deceleration in nonresidential fixed investment that were partly offset by accelerations in exports and in PCE. USDOC |

31 May 2012

∙ U.S. GDP in Q1 Was Lower Than Previously Reported

• U.S. Initial Unemployment Claims Up 10K

|

In the week ending May 26, the advance figure for seasonally adjusted initial claims was 383,000, an increase of 10,000 from the previous week's revised figure of 373,000 but down 9.7% from the same week a year ago. The 4-week moving average was 374,500, an increase of 3,750 from the previous week's revised average of 370,750. The advance seasonally adjusted insured unemployment rate was 2.6 percent for the week ending May 19, unchanged from the prior week's unrevised rate. The highest insured unemployment rates in the week ending May 12 were in Alaska (4.9), Puerto Rico (4.0), California (3.6), Pennsylvania (3.6), New Jersey (3.3), Oregon (3.3), Connecticut (3.2), Illinois (3.0), Nevada (3.0), and Rhode Island (3.0). The largest increases in initial claims for the week ending May 19 were in California (+2,716), Texas (+1,648), South Carolina (+1,029), Florida (+913), and Maryland (+626), while the largest decreases were in Wisconsin (-1,240), Michigan (-716), Georgia (-691), Pennsylvania (-594), and Washington (-447). Click on chart to enlarge Note: “Insured rate” refers to individuals who are unemployed and receiving UC benefits. Source: USDOL-BLS |

• U.S. Social Security Administration Now Provides Online Statements

|

To get to your Statement online, you must first create a my Social Security account. Once you have an account, you can view your Social Security Statement at any time.

Information available in the online statement includes:

• Estimates of the retirement and disability benefits one may receive; • Estimates of benefits the family may get when one receives Social Security or dies; • A list of lifetime earnings according to Social Security’s records; • The estimated Social Security and Medicare taxes paid; • Information about qualifying and signing up for Medicare; • Things to consider for those age 55 and older who are thinking of retiring; • The opportunity to apply online for retirement and disability benefits; and • A printable version of one’s Social Security Statement. Source: SocialSecurity.gov |

30 May 2012

∙ Connecticut Employment Advertising Flopped in May

|

Online advertised vacancies in Connecticut dipped 2.1% in May, according to The Conference Board Help Wanted OnLine® (HWOL) Data Series. As compared to the same month a year ago, they were up only 0.2%. In Hartford, the only city in Connecticut included in the report, ads fell 0.8% for the month but were +2.1% as compared to May 2011. ”Online labor demand in the Northeast rose by 6,300 in May. Massachusetts rose 2,200 for a six-month gain of 14,100. New York rose 2,100 in May and has been up 20,400 over the past four months, with strong gains in Buffalo (up 15.6 percent), Rochester (up 13.5 percent), and the New York metro area (up 5.4 percent). Demand in Pennsylvania remained constant. New Jersey fell 700. Among the smaller States in the Northeast, demand dropped by 900 in both Rhode Island and Maine, and by 800 in New Hampshire….” Source: The Conference Board |

∙ U.S. Job Advertising Fell Off in May

|

”Online advertised vacancies dipped 45,700 in May to 4,714,800, according to The Conference Board Help Wanted OnLine® (HWOL) Data Series…." [However, ads were 8.2% above those placed in May 2011.]

”The Supply/Demand rate stands at 2.6 unemployed for every vacancy…. “’After rising 564,000 over the last five months, labor demand dipped in May. Despite this drop, strong employer demand has created growing opportunities for both job-changers and the unemployed and has also helped significantly lower the unemployment rate…’ said June Shelp, Vice President at The Conference Board. "In May over half of the 50 States are now posting advertised vacancies that are above their pre-recession highs. The largest gains were in the Midwest with Michigan up 53 percent from its pre-recession high. Other Midwestern States with increases above 40 percent include North Dakota (46%), Indiana (44%), and Ohio (41%).” Source: The Conference Board |

• Connecticut Metropolitan Area Employment and Unemployment: April 2012

|

Unemployment: The USDOL report on U.S. major metropolitan employment and unemployment includes six areas in Connecticut: Bridgeport-Stamford-Norwalk, Danbury, Hartford-West Hartford-East Hartford, New Haven, Norwich-New London, and Waterbury. Unemployment rates in April were lower in each of the six areas as compared to 12 months ago

The Connecticut statewide unemployment rate in April was 7.5 percent, not seasonally adjusted, down from 8.7 percent a year earlier. Employment: In April, Danbury, Hartford, New Haven, and Waterbury reported over-the-year increases in nonfarm payroll employment, Bridgeport-Stamford-Norwalk and Norwich-New Haven reported decreases. Source: USDOL Map Source: new-england-vacations-guide.com |

• U.S. Metropolitan Area Employment and Unemployment: April 2012

|

Unemployment: Rates were lower in April than a year earlier in 342 of the 372

metropolitan areas, higher in 25 areas, and unchanged in 5 areas. Ten areas recorded jobless rates of at least

15.0 percent, while 32 areas registered rates of less than 5.0 percent.

The national unemployment rate in April was 7.7 percent, not seasonally adjusted, down from 8.7 percent a year earlier. Employment: In April, 246 metropolitan areas reported over-the-year increases in nonfarm payroll employment, 115 reported decreases, and 11 had no change. Source: USDOL Map Source: worldatlas.com |

• Social Security Disability Trust Fund Bankrupt in 2016

|

”A government entitlement program is headed for insolvency in four years, and it’s not the one members of Congress are talking about most.

"The Social Security disability program’s trust fund is projected to run out of cash far sooner than the better-known Social Security retirement plan or Medicare. That will trigger a 21 percent cut in benefits to 11 million Americans — people with disabilities, plus their spouses and children — many of whom rely on the program to stay out of poverty.” Source: WashingtonPost.com |

• OSHA Wants to Prevent Heat-Related Illnesses and Fatalities Among Outdoor Workers

|

Every year, thousands of workers across the country suffer from serious heat-related illnesses. If not quickly addressed, heat exhaustion can become heat stroke, which has killed – on average – more than 30 workers annually since 2003.

Labor-intensive activities in hot weather can raise body temperatures beyond the level that normally can be cooled by sweating. Heat illness initially may manifest as heat rash or heat cramps, but quickly can become heat exhaustion and then heat stroke if simple prevention steps are not followed. Further Information: USDOL-OSHA |

29 May 2012

• U.S. Consumer Confidence Fell Off in May

|

”The Conference Board Consumer Confidence Index®, which had declined slightly in April, fell further in May. "The Index now stands at 64.9 (1985=100), down from 68.7 in April. "The Expectations Index declined to 77.6 from 80.4, while the Present Situation Index decreased to 45.9 from 51.2 last month…. “Says Lynn Franco, Director of Economic Indicators at The Conference Board: ‘Consumer Confidence fell in May, following a slight decline in April. Consumers were less positive about current business and labor market conditions, and they were more pessimistic about the short-term outlook. However, consumers were more upbeat about their income prospects, which should help sustain spending. Taken together, the retreat in the Present Situation Index and softening in consumer expectations suggest that the pace of economic growth in the months ahead may moderate....’” Source: The Conference Board |

• Still Another Connecticut Employer Closing…in Danbury This Time

|

The Connecticut Department of Labor says that RR Donnelley in Danbury will lay off 153 workers effective 7/22/12 at which time it is closing.

The company says about itself, "A Fortune 500 company with locations around the world, RR Donnelley produces printed and digital communications." In a recent news release the employer said: "R.R. Donnelley & Sons Company (Nasdaq:RRD) today reported first-quarter net earnings attributable to common shareholders of $37.4 million, or $0.21 per diluted share, on net sales of $2.5 billion compared to net earnings of $33.9 million, or $0.16 per diluted share, on net sales of $2.6 billion in the first quarter of 2011." Some of the employees being laid off are represented by the Teamsters union [IBT]. Source: CTDOL |

• Employment in Connecticut’s Industries: April 2012

|

The growing industries in our state were led by professional and business services (900, 0.5%). This is the second fastest growing industry since April 2011 (+1,700, 0.9%). Trade, transportation, and utilities (500, 0.2%) also added jobs, with retail trade (1,400, 0.8%) responsible for all of the gains, as both wholesale trade (-700, -1.1%) and transportation, warehousing, and utilities (-200, -0.4%) had job losses. This industry is higher by 1,400 (0.5%) over the year.

Financial activities increased 300 positions (0.2%) for the second monthly gain in a row. Together, finance and insurance (200, 0.2%) and real estate (100, 0.5%) contributed to the monthly gains, but they are still down substantially over the year (-3,300, -2.4%). The information industry was higher by 100 (0.3%), a 500 gain (1.6%) since April 2011. The six declining industries in April were led by a significant drop in construction and closely related mining (-2,300, -0.4%). This brings the building trades to an even 50,000 employment level in April, down 1,300 (-2.7%) over the year. This is the second large drop in the building trades after large job gains in January and February. Government continues its weakness dropping -1,300 jobs (-0.6%) over the month. Local government led public sector job declines in April (-1,300, -0.9%) and federal government was lower as well (-100, -0.6%), while state government added jobs (100, 0.2%). Leisure and hospitality shed 1,200 jobs (-0.9%) over the month. The two subcomponents exhibited declines, with accommodations and food services (-1,100, -1.0%) providing most of the loss. Arts, entertainment, and recreation groupings were slightly lower by -100 (-0.4%). Education and health services was lower by -600 (-0.2%). This is the first monthly drop in this industry since February 2011. Nevertheless, education and health services continued to be the fastest growing industry over the year (7,700, 2.5%). Manufacturing lost 400 positions (-0.2%) over the month and is lower since April 2011 (-1,400, -0.8%). The entire production sector decline came from the durable goods segment (-400, -0.3%) in April, and durables are down over the year (-1,600, -1.2%). Non-durable goods components were unchanged this month but have exhibited a slight gain over the year (200, 0.5%). Source: CTDOL |

28 May 2012

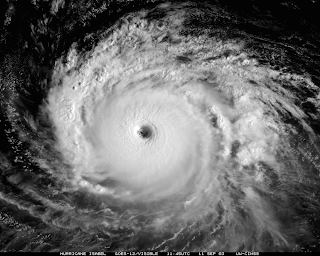

• NOAA Predicts A Near-Normal 2012 Atlantic Hurricane Season

”Conditions in the atmosphere and the ocean favor a near-normal hurricane season in the Atlantic Basin this season, NOAA announced today from Miami at its Atlantic Oceanographic and Meteorological Laboratory, and home to the Hurricane Research Division.” |

• Time for Lyme Disease and Other Tick-Borne Illnesses

|

”As spring rolls into summer, more outside work picks up, and the chances of being exposed to tick-borne illnesses increase. "If you have employees who work outdoors in heavily wooded or grassy areas, give your workers valuable information on common tick-borne illnesses—as well as the ways to prevent getting bitten.” Source: Business & Legal Resources Photo source: MayoClinic.com |

27 May 2012

• Foreign-Born Workers in U.S.

|

The unemployment rate for the foreign born was 9.1 percent in 2011, down from 9.8

percent in 2010. The jobless

rate of the native born was 8.9 percent in 2011, compared with 9.6 percent in the

prior year.

In 2011, there were 24.4 million foreign-born persons in the U.S. labor force, comprising 15.9 percent of the total. Hispanics accounted for 49.0 percent of the foreign-born labor force in 2011. Asians accounted for 22.3 percent. Foreign-born workers were more likely than native-born workers to be employed in service occupations; production, transportation, and material moving occupations; and natural resources, construction, and maintenance occupations. The median usual weekly earnings of foreign-born full-time wage and salary workers were $609 in 2011, compared with $780 for their native- born counterparts. Source: USDOL-BLS |

25 May 2012

• Are Employers Liable for Home Office Injuries?

|

”...the rules put you in a double bind. You can't ensure safety in a home office, but you can be blamed for an accident. Not exactly fair or sensible. ”Add to that the fact that if there is an accident that an employee feels is the employer's responsibility, he or she can file a civil lawsuit for damages and/or file a claim for workers' compensation....” Source: Business & Legal Resources |

• U.S. Consumer Sentiment Improved in May

|

”The Reuter's/University of Michigan's consumer sentiment index in early May was up a solid 1.4 points at mid-month to a preliminary 77.8 versus April's 76.4. The latest reading edged out February 2011 for the best reading so far of the recovery. "The latest report showed a decline in the expectations component, which is now off recovery highs with a six tenth dip to 71.7. Optimism over the future is limited, a factor that limits consumer spending. "The good news in the report was a rise in the assessment of current conditions, up a very strong 4.4 points to a recovery best 87.3” See the detailed report at: Online.WSJ.com |

• 42,000 Serious Accidents, 420 Deaths Memorial Day Weekend

|

”Memorial Day is May 30 but it is observed on the last Monday in May. It is always a 3.25-day weekend consisting of Friday evening, Saturday, Sunday, and Monday. "In 2012, the holiday period extends from 6:00 p.m. Friday, May 25, to 11:59 p.m. Monday, May 28.1” |

• Middlesex, CT County Career Fair – 19 June

|

”The annual Middlesex County Career Fair, co-sponsored by the Connecticut Department of Labor, the Middlesex Chamber of Commerce and the Workforce Alliance, will be held at the Crowne Plaza in Cromwell on June 19; the event will run from 11 a.m. to 3 p.m. “Representatives from more than 40 companies are expected to take part and will be available to talk one-on-one with attendees about possible openings with their companies--everything from entry level positions to management jobs. ”Employer registration fee is $275 ($25 additional with internet access). The fee includes a boxed lunch, skirted table, company sign, program guide listing, and extensive advertising on radio, newspaper, and the Internet Details and online employer registration can be accessed at www.middlesexchamber.com or by contacting Johanna Bond at the Middlesex Chamber of Commerce (860) 374-6924.” Source: CTDOL |

24 May 2012

• Connecticut’s Hours of Work: April 2012

|

The workweek for employees in the private sector, not seasonally adjusted, averaged 34.3 hours in April 2012, up 0.4 hours (1.2%) from the April 2011 figure of 33.9 hours. Click on chart to enlarge: CTDOL says, "This matches the highest ever reached for April hours worked (April 2007, not seasonally adjusted) of all private sector employees since this series began in January 2007 (before the recession started in March 2008)." Further, "The level of hours worked in the private sector is back to pre-recession levels." Source: CTDOL |

• U.S. Initial Unemployment Claims Down 2K

|

In the week ending May 19, the advance figure for seasonally adjusted initial claims was 370,000, a decrease of 2,000 from the previous week's revised figure of 372,000 and down 12.7% from the same week a year ago. Click on chart to enlarge: The advance seasonally adjusted insured unemployment rate was 2.6 percent for the week ending May 12, unchanged from the prior week's unrevised rate. The highest insured unemployment rates in the week ending May 5 were in Alaska (4.9), California (3.6), Puerto Rico (3.6), Pennsylvania (3.5), New Jersey (3.4), Oregon (3.4), Connecticut (3.2), Illinois (3.1), Nevada (3.1), Rhode Island (3.0), and Wisconsin (3.0). The largest increases in initial claims for the week ending May 12 were in North Carolina (+1,956), Mississippi (+675), Tennessee (+474), Alabama (+428), and Florida (+373), while the largest decreases were in California (-3,478), New York (-3,094), Missouri (-2,111), Texas (-1,446), and Illinois (-1,316). Note: “Insured rate” refers to individuals who are unemployed and receiving UC benefits. Source: USDOL-BLS |

• U.S. Durable Good Orders Increased in April

|

New orders for manufactured durable goods in April increased $0.3 billion or 0.2 percent to $215.5 billion. This increase, up two of the last three months, followed a 3.7 percent March decrease. Excluding transportation, new orders decreased 0.6 percent. Excluding defense, new orders increased 1.2 percent. Transportation equipment, also up two of the last three months, had the largest increase, $1.3 billion or 2.1 percent to $62.2 billion. This was due to motor vehicles and parts, which increased $2.3 billion. Source: USDOC |

23 May 2012

• Nonexempt vs. Exempt: 10 Factors Determining Discretion and Independent Judgment

|

”Anyone with even peripheral functions to payroll knows how important it is to properly classify your nonexempt vs. exempt workers to ensure you’re compensating fairly. But the terminology involved can be misleading: Labeling someone as a manager or executive, for example, does not automatically make them exempt employees. They must meet the criteria for these exemptions to apply. "Are you in compliance for your exempt workers?” Read more at: Business & Legal Resources |

• Shelton, CT Employer to Close…Layoff 122

|

The Connecticut Department of Labor says that the W.E. Bassett Company, Inc. of Shelton is closing and will layoff 122 workers between 8/3/12 and 1/31/13. In existence since 1947, the firm has been noted for its “Trim” line of beauty products. Source: CTDOL |

• U.S. New Home Sales Improved in April

|

Sales of new single-family houses in April 2012 were at a seasonally adjusted annual rate of 343,000. This is 3.3 percent (±12.3%) above the revised March rate of 332,000 and is 9.9 percent (±14.7%) above the April 2011 estimate of 312,000. The median sales price of new houses sold in April 2012 was $235,700; the average sales price was $282,600. The seasonally adjusted estimate of new houses for sale at the end of April was 146,000. This represents a supply of 5.1 months at the current sales rate. Source: USDOC |

• Connecticut’s Average Wages: April 2012

|

Average hourly earnings at $28.51, not seasonally adjusted, are now up thirty cents, or 1.1%, higher than last April. Click on chart to enlarge The resulting average private sector weekly pay estimate was $977.89, up $27.21, or 2.9% over the year. CTDOL says, "This compared favorably to the change in the Consumer Price Index – For All Urban Consumers (CPI-U) since last April (2.3%)." [Which is true if you're willing to disregard the fact that employees had to work longer hours to stay up with the CPI.] Source: CTDOL |

22 May 2012

• Ex-NLRB Member Becker Goes Back Where He Belongs

|

”Craig Becker, a former member of the National Labor Relations Board (NLRB), is returning to the AFL-CIO. ”Becker will be general counsel to the nation’s largest labor federation, joining AFL-CIO General Counsel Lynn Rhinehart in leading the labor group’s legal office. Becker was recess-appointed to the NLRB in 2010 by President Obama….” Source: TheHill.com Photo source unknown |

U.S. Mass Layoffs - April 2012

|

Nationally, employers took 1,421 mass layoff actions in April involving 146,358 workers, as measured by new filings for unemployment insurance benefits during the month, not seasonally adjusted. Each mass layoff involved at least 50 workers from a single employer. In April 2011 employers undertook 1,750 mass layoffs affecting 189,919 employees. Click on chart to enlarge: Mass layoff events in April increased by 296 from March, while the number of associated initial claims increased by 28,541. In the northeast [New Jersey and Pennsylvania north to Maine] employers took 363 mass layoff actions in April involving 48,882 workers, not seasonally adjusted. The number of layoffs was down 39 and the number of workers affected down 5,247 as compared to the same month in 2011 Connecticut employers took six mass layoffs, down from 10 in April of 2011; the number of workers affected was 530 as compared to 1,056 a year ago. USDOL |

• Connecticut’s Recession Recovery

|

Connecticut has now recovered 34,100, or 29.0%, of the 117,500 total nonfarm jobs lost in the March 2008 - February 2010 recessionary downturn. Total private sector job growth from the Connecticut employment recessionary period has been doing appreciably better than overall nonfarm job growth. Click on chart to enlarge: The private sector has regained 44,400 (40.3%) of the 110,200 private jobs lost in the recessionary downturn. Offsetting government job losses have hindered overall job growth in this recovery, as public sectors have continued to lose jobs even in the 26 months since the recovery began. Financial activities is the only other major industry that has continued to lose employment since the upturn began. The current job recovery highpoint is February 2012 (1,634,900) for Connecticut. Source: CTDOL |

21 May 2012

• Connecticut Unemployment: April 2012

|

Connecticut’s unemployment rate was measured at 7.7% for April 2012. This is unchanged from March 2012, and one and three-tenths percentage points lower than April 2011 (9.0%). The unemployment rate in Connecticut has not been this low since March 2009 when it was also 7.7%. Click on chart to enlarge: The estimate of people unemployed, seasonally adjusted, was down 1,000 from March 2012 to 147,100. The April national rate was 8.1%. Both the over-the-year drop in the number of unemployed (-25,300) and the decline in the unemployment rate (-1.3%) are considered statistically significant. April’s average weekly initial unemployment claims for first-time filers decreased over the month by 125 (2.5%) to 4,798, and were down 378 claims from this time last year, or -7.3%. Source: CTDOL |

∙ CTDOL’s Take On April Employment Numbers

|

”Preliminary April employment estimates show Connecticut lost 4,100 total nonfarm jobs even while the unemployment rate held steady at 7.7%. “’The decline in both monthly and annual job growth numbers in April is disappointing, but unusual seasonal patterns this past winter into spring make these numbers difficult to interpret,’ noted Andy Condon, Director of Office of Research. ‘Despite variability in growth from month to month we still appear to be on a path of positive, albeit modest job growth.’” Click on chart to enlarge: CTDOL further states, “Unusual weather patterns both years (a severe winter in early 2011 and unusually warm weather in early 2012) make month-to-month and April-to-April comparisons difficult to interpret. Some of the observed decline may be a statistical seasonal adjustment reversal from the unusual boost we received due to an enhanced warm winter in January (+5,400) and February (+6,000). ”The ‘normal’ upticks seen in the spring never fully materialized, in part because job levels in key sectors were already high due to a mild winter. In addition, the April 2011 job counts showed an unusually high and atypical gain (+9,400, 0.6%) which makes the April 2012 performance look weak. In April 2011, Connecticut was coming off a very snowy winter and experienced very strong seasonal April job growth which was not sustained in subsequent months.” Source: CTDOL |

20 May 2012

∙ Connecticut Lost 4,100 Jobs in April

|

Preliminary April employment estimates show Connecticut continues to experience reversal from strong winter job growth in April by declining 4,100 total nonfarm jobs even while the unemployment rate held steady at 7.7%. The unemployment rate, unchanged at 7.7% this month, is down 1.3 percentage points over the year. The number of unemployed in the state dropped 1,000 this month and is now lower by 25,300 since April 2011. Source: CTDOL |

18 May 2012

∙ U.S. Regional and State Unemployment, Employment – April 2012

|

Unemployment: Regional and state unemployment rates were little changed in April. Thirty-seven states and the District of Columbia recorded unemployment rate decreases, five states posted rate increases, and eight states had no change. As compared to a year ago, forty-eight states and the District of Columbia registered unemployment rate decreases from a year earlier, while only one state experienced an increase and one had no change. The national jobless rate was little changed from March at 8.1 percent but was 0.9 percentage point lower than in April 2011. Employment: In April 2012, nonfarm payroll employment increased in 32 states and the District of Columbia and decreased in 18 states. Source: USDOL |

17 May 2012

∙ Connecticut Expands Motorist “Move Over” Law

|

The “move over” law requires a motorist approaching one or more stationary emergency vehicles located on the travel lane, breakdown lane, or shoulder of a highway to (1) immediately slow to a reasonable speed below the posted speed limit and (2) move over one lane if traveling in the lane adjacent to the location of the emergency vehicle, unless this would be unreasonable or unsafe. This bill applies the “move over” law to two-lane highways. The current law applies to highways with three or more lanes. For these requirements to apply, the emergency vehicle must have flashing lights activated. For purposes of the “move over” law, an “emergency vehicle” includes a maintenance vehicle or wrecker or a vehicle operated by: 1. a member of an emergency medical service organization responding to an emergency call; 2. a fire department or an officer of the department responding to a fire or other emergency; or 3. a police officer. A violation of these requirements is an infraction, unless the violation results in the injury or death of the emergency vehicle operator, in which case the fines are a maximum of$ 2,500 and $ 10,000, respectively. Effective Date: October 1, 2012 Source: Connecticut General Assembly |

∙ U.S. Leading Incators…Leading Nowhere Right Now

|

”The Conference Board Leading Economic Index® (LEI) for the U.S. declined 0.1 percent in April to 95.5 (2004 = 100), following a 0.3 percent increase in March, and a 0.7 percent increase in February. ”Says Ataman Ozyildirim, economist at The Conference Board: ‘The LEI declined slightly in April. Falling housing permits, rising initial claims for unemployment insurance and subdued consumer expectations offset small gains in the remaining components. The LEI’s six-month growth rate fell slightly, but remains in expansionary territory and well above its growth at the end of 2011....’ ”Says Ken Goldstein, economist at The Conference Board: ‘The indicators reflect an economy that’s still struggling to gain momentum. Growth is slow, but choppy, and consumers, executives and investors are looking for more progress.’” Source: The Conference Board |

∙ Fluctuating Workweek Method of OT Pay Upheld by Connecticut Court

|

”Connecticut state law, like the federal Fair Labor Standards Act (“FLSA”), requires employers to pay non-exempt employees one-and-one-half times their regular rate of pay for any hours worked in a workweek in excess of 40. A Connecticut Superior Court has held that the fluctuating workweek method (“FWW”) of overtime calculation complies with Connecticut state wage law.” Source: JacksonLewis.com |

∙ Connecticut DOL Recordkeeping Workshop Scheduled for June 6

|

Recordkeeping will be the subject of a June 6 workshop sponsored by the Connecticut Department of Labor's Division of Occupational Safety and Health (CONN‐OSHA). The session will provide attendees with expert guidance and tips for ensuring information is maintained accurately and properly kept up‐to‐date. Attendees will learn how to properly maintain the following three OSHA documents: • Form 300: Log of Work‐Related Injuries and Illnesses • Form 300A: Summary of Work‐Related Injuries and Illnesses • Form 301: Injury and Illness Incident Report To register for the workshop, contact CONN‐OSHA Training Officer John Able at (860) 263‐6902 or via e‐mail at able.john@dol.gov. Source: CONN-OSHA |

U.S. Initial Unemployment Claims Down 11.5% from Year Ago

|

In the week ending May 12, the advance figure for seasonally adjusted initial claims was 370,000, unchanged from the previous week's revised figure of 370,000 but down 11.5% from the same week a year ago. The 4-week moving average was 375,000, a decrease of 4,750 from the previous week's revised average of 379,750. The advance seasonally adjusted insured unemployment rate was 2.6 percent for the week ending May 5, unchanged from the prior week's revised rate. The highest insured unemployment rates in the week ending April 28 were in Alaska (5.3), Puerto Rico (3.9), California (3.7), Pennsylvania (3.6), New Jersey (3.5), Oregon (3.5), Connecticut (3.3), Rhode Island (3.2), Illinois (3.1), Nevada (3.1), and Wisconsin (3.1). The largest increases in initial claims for the week ending May 5 were in Missouri (+2,569), New York (+2,276), Pennsylvania (+1,674), California (+1,613), and Texas (+1,229), while the largest decreases were in Florida (-2,599), Indiana (-1,735), Connecticut (-1,038), New Hampshire (-836), and Massachusetts (-668). Note: “Insured rate” refers to individuals who are unemployed and receiving UC benefits. Source: USDOL |

16 May 2012

∙ CTDOL Issues 13 Stop-Work Orders

|

”The Connecticut Department of Labor’s Division of Wage and Workplace Standards issued Stop Work orders to 13 companies working at construction project sites in Greenwich, Danbury, New London, Preston, Naugatuck, and Simsbury during the period of April 12 to May 7…” Source: CTDOL |

∙ “NLRB Can Revive Speedy Union Vote Rule Judge Threw Out”

|

“A National Labor Relations Board rule to speed up elections on whether to form a union, thrown out on a technicality yesterday by a federal judge, could be quickly reinstated, according to labor lawyers. US District Judge James Boasberg ruled yesterday....” Source: Bloomberg.com |

∙ U.S. and Connecticut Extended Mass Layoffs – Q1, 2012

|

U.S.Employers in the private nonfarm sector initiated 1,077 mass layoff events in the first quarter of 2012 that resulted in the separation of 182,101 workers from their jobs for at least 31 days. Over the year, total extended mass layoff events and associated worker separations were down from 1,490 and 225,456, respectively. Total events reached their lowest first quarter levels since 2006, while manufacturing sector events and separations declined to their lowest levels in program history (with data available back to 1995.) Connecticut endured seven mass layoffs in Q1, up from 6 the prior quarter and from 10 in A1 2011. There were 666 employees separated, down from 689 the previous quarter and down from 3,544 in the same quarter a year ago. Source: USDOL-BLS |

∙ U.S. Industrial Productions and Capacity Utilization – April 2012

|

Industrial production increased 1.1 percent in April. Output is now reported to have fallen 0.6 percent in March and to have moved up 0.4 percent in February; previously, industrial production was estimated to have been unchanged in both months. Manufacturing output increased 0.6 percent in April after having decreased 0.5 percent in March. Excluding motor vehicles and parts, which increased nearly 4 percent, manufacturing output moved up 0.3 percent, and output for all but a few major industries increased. Production at mines rose 1.6 percent, and the output of utilities gained 4.5 percent after unseasonably warm weather in the first quarter held down demand for heating. At 97.4 percent of its 2007 average, total industrial production for April was 5.2 percent above its year-earlier level. The rate of capacity utilization for total industry moved up to 79.2 percent, a rate 3.1 percentage points above its level from a year earlier but 1.1 percentage points below its long-run (1972--2011) average. Source: Federal Reserve |

∙ U.S. Building Permits and Housing Starts - April 2012

|

Building Permits: Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 715,000.

This is 7.0 percent (±1.0%) below the revised March rate of 769,000, but is 23.7 percent (±1.9%) above the revised April 2011 estimate

of 578,000.

Single-family authorizations in April were at a rate of 475,000; this is 1.9 percent (±1.1%) above the revised March figure of 466,000. Authorizations of units in buildings with five units or more were at a rate of 217,000 in April. Housing Starts: Privately-owned housing starts in April were at a seasonally adjusted annual rate of 717,000. This is 2.6 percent (±14.8%) above the revised March estimate of 699,000 and is 29.9 percent (±15.2%) above the revised April 2011 rate of 552,000. Single-family housing starts in April were at a rate of 492,000; this is 2.3 percent (±11.9%) above the revised March figure of 481,000. The April rate for units in buildings with five units or more was 217,000. Source: USDOC |

U.S. and Connecticut Manufacturing and Trade Inventories and Sales - March 2012

|

Sales: The combined value of distributive trade sales and manufacturers’ shipments for March, adjusted for seasonal and trading-day differences but not for price changes, was estimated at $1,241.0 billion, up 0.6 percent (±0.2%) from February 2012 and up 5.8 percent (±0.5%) from March 2011. Inventories: Manufacturers’ and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,580.2 billion, up 0.3 percent (±0.1%) from February 2012 and up 6.6 percent (±0.4%) from March 2011. Inventories/Sales Ratio: The total business inventories/sales ratio based on seasonally adjusted data at the end of March was 1.27. The March 2011 ratio was 1.26. Source: USDOC |

∙ ”401(k) Fee Disclosures: DOL Provides More Guidance"

|

The [USDOL] has issued Field Assistance Bulletin No. 2012-02 to supplement the regulations on fee disclosures to 401(k) plan participants. The Bulletin is in the form of 38 questions and answers and also provides guidance on the related requirement on service providers to furnish specified information to plan administrators so that administrators may comply with their disclosure obligations to 401(k) plan participants.” |

15 May 2012

∙ U.S. Average Pay: Weekly Salaries Up 2.1% in Past 12 Months

|

Although U.S. average weekly pay is up 2.1% in the past 12 months, when adjusted for inflation salaries actually fell. Current Earnings: U.S. Average weekly earnings grew 2.1%, seasonally adjusted, from April 2011 to April 2012. During the same period, average hourly earnings also grew…by 1.8%. Real* Earnings: Real average weekly earnings fell 0.2% over the past year seasonally adjusted; real average hourly earnings decreased 0.5%. This chart shows that although U.S. average hourly rates have been rising, the effect of inflation has reduced the effective purchasing power of those earnings. *Note: Real earnings show the effect of inflation on your pay. If your salary went up by 2.1% over the year while the cost-of-living (CPI-U) rose 2.3%, then the “real” value of your salary fell by 0.2% [differences in some of the data are due to rounding and seasonal adjustment]. The figures reported here are earnings for all employees on private nonfarm payrolls, seasonally adjusted. Source: USDOL-BLS |

∙ U.S. Retail Sales Up 0.1% in April

|

U.S. retail and food services sales for April, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $408.0 billion, an increase of 0.1 percent (±0.5%) from the previous month and 6.4 percent (±0.7%) above April 2011. Total sales for the February through April 2012 period were up 6.6 percent (±0.5%) from the same period a year ago. The February to March 2012 percent change was revised from 0.8 percent (±0.5) to 0.7 percent (±0.3%). Retail trade sales were up 0.1 percent (±0.5%)* from March 2012 and 6.1 percent (±0.7%) above last year. Nonstore retailers sales were up 11.0 percent (±3.1%) from April 2011 and building material and garden equipment and supplies dealers were up 10.3 percent (±2.8%) from last year. Source: USDOC |

∙ U.S. Consumer Prices Up 2.3% in Year

|

The Consumer Price Index for All Urban Consumers (CPI-U) increased 2.3 percent over the last 12 months to an index level of 230.085 (1982-84=100). For the month, the index increased 0.3 percent prior to seasonal adjustment. The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 2.4 percent over the last 12 months to an index level of 227.012 (1982-84=100). For the month, the index increased 0.3 percent prior to seasonal adjustment. The Chained Consumer Price Index for All Urban Consumers (C-CPI-U) increased 2.1 percent over the last 12 months to an index level of 131.731. For the month, the index increased 0.3 percent on a not seasonally adjusted basis. Note: The Consumer Price Index for May 2012 is scheduled to be released on Thursday, June 14, 2012, at 8:30 a.m. (EDT). Source: USDOL-BLS |

14 May 2012

∙ Connecticut Employer to Lay-Off 187

|

CTDOL says that Hostess Brands, Inc. will layoff 187 workers at the company’s locations in Uncasville, Norwich, East Windsor, Cheshire, and Bridgeport on or about 06 July 2012 “if layoffs are necessary.” CTDOL says the corporation may “possibly” be closing these facilities. Hostessbrands.com states that the organization’s bread and snack-cake products include Wonder, Nature's Pride, Dolly Madison, Home Pride, and Drake's. Source: CTDOL |

∙ Consumer Prices for NY-NJ-CT

|

Prices in the New York-Northern New Jersey-Long Island area, as measured by the Consumer Price Index for All Urban Consumers (CPI-U), increased 0.6 percent in March, not seasonally adjusted. The U.S. CPI-U increased 0.8% [sa] in the same period. For the year ended in March 2012, the CPI-U rose 2.6 percent [the U.S. CPI-U increased 2.7% (sa) in the same period], reflecting higher prices for shelter, food, and gasoline. The index for all items less food and energy increased 2.5 percent. For both indexes, the 12-month percent increase has changed relatively little since December. The New York-Northern New Jersey-Long Island, N.Y.-N.J.-Conn.-Pa. consolidated area covered in this release comprises Bronx, Dutchess, Kings, Nassau, New York, Orange, Putnam, Queens, Richmond, Rockland, Suffolk, and Westchester Counties in New York State; Bergen, Essex, Hudson, Hunterdon, Mercer, Middlesex, Monmouth, Morris, Ocean, Passaic, Somerset, Sussex, Union, and Warren Counties in New Jersey; Fairfield County and parts of Litchfield, Middlesex, and New Haven Counties in Connecticut; and Pike County in Pennsylvania Source: USDOL-BLS |

11 May 2012

∙ U.S. Producer Price Index – April 2012

|

The Producer Price Index for finished goods fell 0.2 percent in April, seasonally adjusted. Prices for finished goods were unchanged in March and increased 0.4 percent in February. At an Index level of 193.8, the PPI is 1.5% higher [sa] than it was in the same month a year ago. At the earlier stages of processing, prices received by manufacturers of intermediate goods decreased 0.5 percent in April, and the crude goods index moved down 4.4 percent. On an nsa basis, prices for finished goods advanced 1.9 percent for the 12 months ended in April, the seventh straight month of slowing year-over-year increases following a 7.0-percent rise for the 12 months ended September 2011. Note: The Consumer Price Index for April 2012 is scheduled to be released on Tuesday, May 15, 2012, at 0830 (EDT). Source: USDOL |

∙ U.S. Job Openings and Hires - March 2012

|

Job Openings: There were 3.678 million job openings available in the U.S. on the last business day of March, an increase of 315,000 jobs from the end of February and 18.6% higher than at the end of March 2011. Hires: During the month of March 2012, U.S. employers hired 4.117 workers, up 484,000 from February but up only 2% from the same month a year ago. Note that the yellow trendline indicates that job openings are "trending" upward. The data for hires appear much more mixed which some believe is because the persons that are available to be hired do not fulfill the needs of those with job openings. All data nsa Source: USDOL |

10 May 2012

∙ U.S. Initial Unemployment Claims Down 1k

|

In the week ending May 5, the advance figure for seasonally adjusted initial claims was 367,000, a decrease of 1,000 from the previous week's revised figure of 368,000 and down 14.7% from the same week a year ago. The 4-week moving average was 379,000, a decrease of 5,250 from the previous week's revised average of 384,250. The advance seasonally adjusted insured unemployment rate was 2.5 percent for the week ending April 28, a decrease of 0.1 percentage point from the prior week's unrevised rate of 2.6 percent. The highest insured unemployment rates in the week ending April 21 were in Alaska (5.2), Oregon (3.8), Puerto Rico (3.8), California (3.7), Pennsylvania (3.7), Connecticut (3.6), New Jersey (3.6), Rhode Island (3.6), Massachusetts (3.3), and Wisconsin (3.3). The largest increases in initial claims for the week ending April 28 were in Indiana (+2,294), Florida (+1,767), Illinois (+1,512), Pennsylvania (+1,121), and New Hampshire (+836), while the largest decreases were in New York (-21,258), Califorina (-6,790), Massachusetts (-2,530), Georgia (-2,110), and Connecticut (-1,708). Note: “Insured rate” refers to individuals who are unemployed and receiving UC benefits. Source: USDOL |

09 May 2012

∙ U.S. Average Hours of Work

|

The average workweek for all employees on private nonfarm payrolls was unchanged at 34.5 hours in April. The nationwide manufacturing workweek edged up by 0.1 hour to 40.8 hours, and factory overtime rose by 0.1 hour to 3.4 hours. The U.S. average workweek for production and nonsupervisory employees on private nonfarm payrolls was unchanged at 33.8 hours.

Source: USDOL |

∙ U.S. Employment by Industry – April 2012

|

Total nonfarm payroll employment rose by 115,000 in April. This increase followed a gain of 154,000 in March and gains averaging 252,000 per month for December to February. Employment in professional and business services increased by 62,000; since a recent low point in September 2009, employment in this industry has grown by 1.5 million. In April, employment in temporary help services edged up by 21,000. Retail trade employment rose by 29,000 over the month. Health care continued to add jobs (+19,000) in April. Within the industry, employment in ambulatory health care services, which includes home health care and offices of physicians, rose by 15,000. Within leisure and hospitality, employment in food services and drinking places continued to trend up (+20,000) in April. Since February 2010, food services and drinking places has added 576,000 jobs. Manufacturing employment continued to trend up (+16,000) in April, with job growth in fabricated metal products (+6,000) and machinery (+5,000). Since its most recent employment low in January 2010, manufacturing has added 489,000 jobs, largely in durable goods manufacturing. Transportation and warehousing lost 17,000 jobs in April, with employment declines in transit and ground passenger transportation (-11,000) and in couriers and messengers (-7,000). Employment in other major industries, including mining and logging, construction, wholesale trade, information, financial activities, and government changed little in April. Source: USDOL |

08 May 2012

∙ U.S. Employment Turnover – March 2012

|

Job Openings: There were 3.678 million job openings available in the U.S. on the last business day of March, an increase of 315,000 jobs from the end of February and 18.6% higher than at the end of March 2011. Hires: During the month of March 2012, U.S. employers hired 4.117 workers, up 484,000 from February but up only 2% from the same month a year ago. Turnover: 3.510 million workers left their jobs in March; this is up 246,000 from the previous month and up 5.7% from a year ago. Quits: 1.911 workers quit in March, an increase of 273,000 for the month and up 10.5% from last year. This chart shows total turnover, quits, and total turnover without quits as annual percentage rates. Note that total turnover, which had been decreasing, has now leveled off and appears to be on the rise. The quits and turnover without quits lines indicate that most of the leveling-off and increase in total turnover is due to an increase in employee voluntary terminations, aka quits. All data nsa Source: USDOL |

∙ U.S. Average Earnings - April 2012

|

In April, average hourly earnings for all employees on private nonfarm payrolls rose by 1 cent to $23.38. Over the past 12 months, average hourly earnings have increased by 1.8 percent. In April, average hourly earnings of private-sector production and nonsupervisory employees rose by 3 cents to $19.72.

This chart shows average hourly wages, all employees, U.S. vs. Connecticut. [Data for CT in April not yet available. Data for CT will tend to vary more than U.S. as sample size is smaller.] Source: USDOL |

07 May 2012

∙ Employment Cost Index: Wages, Benefits

|

According to the Bureau of Labor Statistics [USDOL], compensation costs rose 0.4% in the quarter December 2011-March 2012, and 1.9% over the year ending March. All Civilian Workers: Wage and benefit costs for civilian workers rose 0.5 percent, seasonally adjusted, from December 2011 to March 2012. As the following chart shows, over the year, compensation rose 1.9 percent, wages and salaries 1.7 percent, and benefits 2.7 percent: Private Industry Workers: Compensation costs for private industry workers increased 2.1 percent over the year, essentially unchanged from the 2.0 percent increase for the previous 12-month period. Wages and salaries increased 1.9 percent for the current 12-month period. The increase in the cost of benefits was 2.8 percent for the 12-month period ending March 2012. The March 2011 increase was 3.0 percent. Employer costs for health benefits increased 3.0 percent for the 12-month period ending March 2012. State and Local Government Workers: Compensation costs for state and local government workers increased 1.5 percent for the 12-month period ending March 2012. Wages and salaries increased 1.0 percent; benefit costs increased 2.3 percent. |

06 May 2012

∙ U.S. Unemployment Among Major Worker Groups

Among the major worker groups, the unemployment rates for adult men (7.5 percent), adult women (7.4 percent), teenagers (24.9 percent), whites (7.4 percent), and Hispanics (10.3 percent) showed little or no change in April, while the rate for blacks (13.0 percent) declined over the month. The jobless rate for Asians was 5.2 percent in April (not seasonally adjusted), little changed from a year earlier. This table shows the difference between the official U.S. unemployment rate [total unemployed, as a percent of the civilian labor force] and an alternative measure of labor underutilization [total unemployed, plus all persons marginally attached to the labor force, plus total employed part time for economic reasons, as a percent of the civilian labor force plus all persons marginally attached to the labor force]: Source: USDOL |

∙ U.S. Employment and Unemployment, April 2012

|

Nonfarm payroll employment rose by 115,000 in April, and the unemployment rate was little changed at 8.1 percent. Employment increased in professional and business services, retail trade, and health care, but declined in transportation and warehousing. Source: USDOL |

∙ U.S. Productivity Declines 0.5% in First Quarter 2012; Unit Labor Costs Rise 2.0%

|

Nonfarm business sector labor productivity decreased at a 0.5 percent annual rate during the first quarter of 2012. The decline in productivity reflects increases of 2.7 percent in output and 3.2 percent in hours worked. (All quarterly percent changes are seasonally adjusted annual rates.) From the first quarter of 2011 to the first quarter of 2012, productivity increased 0.5 percent as output and hours worked rose 2.8 percent and 2.2 percent, respectively. Unit labor costs in nonfarm businesses increased 2.0 percent in the first quarter of 2012, while hourly compensation increased 1.5 percent. Unit labor costs rose 2.1 percent over the last four quarters. Source: USDOL |

∙ U.S. Initial UC Claims Drop 27k

|

In the week ending April 28, the advance figure for seasonally adjusted initial claims was 365,000, a decrease of 27,000 from the previous week's revised figure of 392,000 and down 21.3% from the same week a year ago. The 4-week moving average was 383,500, an increase of 750 from the previous week's revised average of 382,750. The advance seasonally adjusted insured unemployment rate was 2.6 percent for the week ending April 21, unchanged from the prior week. The highest insured unemployment rates in the week ending April 14 were in Alaska (5.6), Puerto Rico (4.2), New Jersey (3.9), Oregon (3.9), Pennsylvania (3.9), California (3.8), Connecticut (3.5),Wisconsin (3.5), Illinois ( 3.4), and Rhode Island (3.4). The largest increases in initial claims for the week ending April 21 were in New York (+15,467), Massachusetts (+4,336), Connecticut (+1,776), Puerto Rico (+1,264), and Rhode Island (+1,163), while the largest decreases were in New Jersey (-5,748), Pennsylvania (-3,080), Wisconsin (-1,841), Ohio (-1,798) and Alabama (-1,444). Note: “Insured rate” refers to individuals who are unemployed and receiving UC benefits. Source: USDOL |

∙ March Jobless Rates Down Over the Year In 342 of 372 Metro Areas

|

Employment: Nationally, nonfarm payroll employment was up over the year in 267 of the 372 major metropolitan areas reported by the USDOL, down in 96, and unchanged in 9. In Connecticut, employment was up in Danbury, Hartford, New Haven, Enfield, Torrington, and Willimantic; and, down in Bridgeport-Stamford, Norwich-New London, and Waterbury. Unemployment: Nationally, jobless rates were lower in March than a year earlier in 342 of the 372 metro areas, higher in 16 areas, and unchanged in 14. In Connecticut, unemployment rates were down in all 9 areas. Source: USDOL |

∙ Average Hourly Wages

|

This chart shows average hourly wages, U.S. and Connecticut, for all employees in private industry, March 2011 to March 2012: Note: Click on chart to enlarge. Source: USDOL and CTDOL |

∙ IRS Sets Annual Contribution Limits for HSAs

|

Annual contribution limitation: For calendar year 2013, the annual limitation on deductions under § 223(b)(2)(A) for an individual with self-only coverage under a high deductible health plan is $3,250. For calendar year 2013, the annual limitation on deductions under § 223(b)(2)(B) for an individual with family coverage under a high deductible health plan is $6,450. High deductible health plan: For calendar year 2013, a “high deductible health plan” is defined under § 223(c)(2)(A) as a health plan with an annual deductible that is not less than $1,250 for self-only coverage or $2,500 for family coverage, and the annual out-of-pocket expenses (deductibles, co-payments, and other amounts, but not premiums) do not exceed $6,250 for self-only coverage or $12,500 for family coverage. Source: IRS |

∙ Cost of Workplace Injuries and Illness Higher Than Expected

|

”In the first comprehensive review of its kind since 1992, a University of California Davis researcher has estimated the national annual price tag of occupational injuries and illnesses at $250 billion. ”That figure is $31 billion more than the direct and indirect costs of all cancers, $76 billion more than diabetes, and $187 more than strokes." To read the complete article, go to: Safety Daily Advisor |

∙ Social Security: Gone in ‘33?

|

“The Social Security Board of Trustees…released its annual report on the financial health of the Social Security Trust Funds. The combined assets of the Old-Age and Survivors Insurance, and Disability Insurance (OASDI) Trust Funds will be exhausted in 2033, three years sooner than projected last year. The DI Trust Fund will be exhausted in 2016, two years earlier than last year’s estimate.” Source: Social Security Administration |

∙ U.S. Personal Income Increased in March

|

Personal income increased $50.3 billion, or 0.4 percent, and disposable personal income (DPI) increased $42.5 billion, or 0.4 percent, in March. Personal consumption expenditures (PCE) increased $29.6 billion, or 0.3 percent. In February, personal income increased $39.6 billion, or 0.3 percent, DPI increased $29.4 billion, or 0.2 percent, and PCE increased $93.7 billion, or 0.9 percent, based on revised estimates. Real disposable income increased 0.2 percent in March, in contrast to a decrease of 0.1 percent in February. Real PCE increased 0.1 percent, compared with an increase of 0.5 percent. Source: USDOC |

∙ U.S. Mass Layoffs in March

|

Nationally, employers took 1,125 mass layoff actions in March involving 117,817 workers, not seasonally adjusted, as measured by new filings for unemployment insurance benefits during the month. Each mass layoff involved at least 50 workers from a single employer. Mass layoff events in March increased by 230 from February, while the number of associated initial claims increased by 32,733. In the northeast [New Jersey and Pennsylvania north to Maine] employers took 198 mass layoff actions in March involving 18,520 workers, not seasonally adjusted. March data for Connecticut did “…not meet BLS or state agency disclosure standards.” USDOL |

∙ GDP Increased at Slower Rate in Q1

|

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.2 percent in the first quarter of 2012 (that is, from the fourth quarter to the first quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2011, real GDP increased 3.0 percent. The fact that GDP rose in the first quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, private inventory investment, and residential fixed investment that were partly offset by negative contributions from federal government spending, nonresidential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased. However, the slowing of growth in real GDP in the first quarter primarily reflected a deceleration in private inventory investment and a downturn in nonresidential fixed investment that were partly offset by accelerations in PCE and in exports. Source: USDOC |