|

SUMMARY: This bill prohibits employers from requesting or requiring an employee or job applicant to (1) provide the employer with a user name, password, or other way to access the employee's or applicant's personal online account (see below); (2) authenticate or access such an account in front of the employer; or (3) invite, or accept an invitation from, the employer to join a group affiliated with such an account.

It bars employers from: • 1. firing, disciplining, or otherwise retaliating against an employee who (a) refuses to provide this access or (b) files a complaint with a public or private body or court about the employer's request for access or retaliation for refusing such access and • 2. refusing to hire an applicant because the applicant would not provide access to his or her personal online account. Under the bill, a “personal online account” is an online account the employee or applicant uses exclusively for personal purposes unrelated to any of the employer's business purposes, including e-mail, social media, and retail-based Internet web sites. It does not include any account created, maintained, used, or accessed by an employee or applicant for the employer's business purposes. The bill makes exceptions for accounts and devices the employer provides and for certain types of investigations. Employers covered by the bill include the state and its political subdivisions, but its prohibitions do not apply to a state or local law enforcement agency conducting a preemployment investigation of law enforcement personnel. The bill allows employees and applicants to file a complaint with the labor commissioner, who can impose civil penalties of up to $25 for initial violations against job applicants and $500 for initial violations against employees. Penalties for subsequent violations can be up to $500 for violations against applicants and up to $1,000 for violations against employees. EFFECTIVE DATE: October 1, 2015 EXCEPTIONS: The bill provides for a number of circumstances in which an employer can request or require an employee or applicant to provide a user name, password, or other authentication means for a personal online account. Employer's Accounts and Devices: It allows an employer to request or require that an employee or applicant provide access to: • 1. any account or service (a) provided by the employer or by virtue of the employee's work relationship with the employer or (b) that the employee uses for business purposes and • 2. any electronic communications device the employer supplied or paid for, in whole or in part. It defines “electronic communications device” as any electronic device capable of transmitting, accepting, or processing data, including a computer, computer network and computer system, as defined in state law, and a cellular or wireless telephone. Investigations: The bill allows exceptions for certain investigations, with limitations. Employers can conduct an investigation: • 1. based on receiving specific information about activity on an employee's or applicant's personal online account to ensure compliance with (a) applicable state or federal laws, (b) regulatory requirements, or (c) prohibitions against work-related employee misconduct or • 2. based on receiving specific information about an employee's or applicant's unauthorized transfer of the employer's proprietary information, confidential information, or financial data to or from a personal online account operated by an employee, applicant, or other source. An employer conducting these investigations can require an employee to provide access to a personal online account, but cannot require disclosure of the user name, password, or other means of accessing the personal online account. For example, an employee or applicant under investigation could be required to privately access a personal online account, but then provide the employer with access to the account content. The bill permits an employer to discharge, discipline, or otherwise penalize an employee or applicant who transferred, without the employer's permission, the employer's proprietary information, confidential information, or financial data to or from the employee or applicant's personal online account. Monitoring and Blocking Data: The bill allows an employer, in compliance with state and federal law, to monitor, review, access, or block electronic data (1) stored on an electronic communications device paid for in whole or in part by the employer or (2) traveling through or stored on an employer's network. State and Federal Laws: The bill specifies that it does not prevent an employer from complying with state or federal laws, regulations, or rules for self-regulatory organizations (e.g., the Securities Exchange Commission's rules). ENFORCEMENT: The bill allows employees and applicants to file complaints with the labor commissioner alleging an employer requested or required access to a personal online account or retaliated for a refusal to provide access in violation of this bill. The commissioner must investigate each complaint and may hold a hearing, after which she must send each party a written decision. Any employee or applicant who prevails in a hearing must be awarded reasonable attorneys' fee and costs. If the commissioner finds an employer violated the bill's ban on requesting access to an employee's account, or retaliated against an employee for refusing to provide access, she can (1) levy a civil penalty against the employer of up to $500 for an initial violation and $1,000 for each subsequent violation and (2) award the employee all appropriate relief, including rehiring or reinstatement, back pay, reestablishment of wages, or any other relief the commissioner deems appropriate. If she finds an employer violated the bill's ban on requesting access to an applicant's account, or refused to hire an applicant for refusing to provide access, she can (1) levy a civil penalty against the employer of up to $25 for an initial violation and $500 for each subsequent violation. The commissioner can ask the attorney general to bring a civil suit to recover any of the above civil penalties. Any party aggrieved by the commissioner's decision can appeal to the Superior Court. NOTE: The analysis provided here may not be based on the ultimate language of the new Public Act as the legislature may have fiddled with it in the final stages of the law’s passage. A final copy of the language of the law can be found at http://www.cga.ct.gov/2015/act/pa/2015PA-00006-R00SB-00426-PA.htm. NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought.. © 2015 Connecticut Human Resource Reports, LLC |

31 May 2015

• Connecticut Public Act 15-6 [SB-0426] — Effective October 1, 2015

29 May 2015

• U.S. Gross Domestic Product — Q1 2015

|

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- decreased at an annual rate of 0.7 percent in the first quarter of 2015, according to the "second" estimate. In the fourth quarter, real GDP increased 2.2 percent. The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, real GDP increased 0.2 percent. With the second estimate for the first quarter, imports increased more and private inventory investment increased less than previously estimated. The decrease in real GDP in the first quarter primarily reflected negative contributions from exports, nonresidential fixed investment, and state and local government spending that were partly offset by positive contributions from personal consumption expenditures (PCE), private inventory investment, and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased. Please visit this link to read the full report: USDOC-BEA NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

28 May 2015

• U.S. Initial Unemployment Claims — 23 May 2015

| In the week ending May 23, the advance figure for seasonally adjusted initial claims was 282,000, an increase of 7,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 274,000 to 275,000.The 4-week moving average was 271,500, an increase of 5,000 from the previous week's revised average. The previous week's average was revised up by 250 from 266,250 to 266,500.

The advance seasonally adjusted insured unemployment rate was 1.7 percent for the week ending May 16, an increase of 0.1 percentage point from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending May 16 was 2,222,000, an increase of 11,000 from the previous week's unrevised level of 2,211,000. The highest insured unemployment rates in the week ending May 9 were in Alaska (3.3), Puerto Rico (2.8), the Virgin Islands (2.6), New Jersey (2.5), California (2.4), Connecticut (2.3), Nevada (2.2), Pennsylvania (2.2), West Virginia (2.1), Illinois (2.0), Massachusetts (2.0), and Wyoming (2.0). The largest increases in initial claims for the week ending May 16 were in Missouri (+1,382), Oregon (+1,002), New York (+965), Kentucky (+604), and Pennsylvania (+575), while the largest decreases were in California (-2,530), South Carolina (-705), Illinois (-648), Colorado (-439), and Georgia (-431). Note: “Insured unemployment rate” refers to individuals who are unemployed and receiving UC benefits. See the complete report at this link: USDOL-BLS NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC URL: http://connecticuthumanresources.blogspot.com/ |

27 May 2015

• U.S. Labor Market Conditions Index — April 2015

|

The Federal Reserve reports that the LMCI for APRIL is: -1.9 Supposedly, values above zero indicate an improving labor market and values below zero indicate a deteriorating labor market. Please visit this link to read the full report: Federal Reserve Fed: “The LMCI is derived from a dynamic factor model that extracts the primary common variation from 19, seasonally-adjusted, labor market indicators. Users can read about the included indicators at: Federal Reserve Information on the LMCI. Users of the LMCI should take note that the entire history of the LMCI may revise each month….” The Wall Street Journal says, “The labor market conditions index is by definition an index. Higher index numbers are positives and vice versa. The report focuses on the change in the index — how strong a plus change or a negative change. Plus indicates improving labor market conditions. But there is extreme detail with 19 components. Subcomponent detail can be important, depending on how many components are positive versus those that are negative or sluggish. A key feature of this report is that it pulls together many labor market indicators into one place.” NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

• U.S. Regional & State Unemployment & Employment — April 2015

|

Unemployment: Regional and state unemployment rates were little changed in April. Twenty-three states and the District of Columbia had unemployment rate decreases from March, 11 states had increases, and 16 states had no change. Forty-five states and the District of Columbia had unemployment rate decreases from a year earlier and five states had increases. Employment: 17 states had statistically significant over-the-month changes in employment, all of which were positive. The largest significant job gains occurred in California (+29,500), Pennsylvania (+27,000), and Florida (+24,500). Please visit this link to read the full report: USDOL-BLS NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

• Connecticut Labor Situation — April 2015

|

Preliminary nonfarm employment estimates from the U.S. Bureau of Labor Statistics (BLS establishment survey) show Connecticut added 1,200 jobs (0.07%) to state payrolls in April 2015 - seasonally adjusted. Connecticut has now increased job levels by 23,200 since April 2014 (1.39%, 1,933 jobs per month) to 1,687,200. March’s initially estimated job increase of 4,000 (0.24%) was revised slightly lower by 700 positions to a 3,300 job gain (0.20%). This is the third monthly employment increase in 2015 and the tenth monthly job gain in the last twelve months. The seasonally adjusted unemployment rate for Connecticut was measured at 6.3% for April 2015, down one-tenth of a percentage point from the March 2015 estimate. The jobless rate in the state is now down by five-tenths of a percentage point from April 2014 (6.8%). The number of unemployed residents in the state has declined by 7,019 (-5.5%) to 120,089 over the year. The state’s labor force expanded briskly again in April by 4,988 participants for the nineteenth consecutive month to reach an all-time record high labor pool of 1,920,837.“This was a relatively quiet month in the job market with mixed results across the state’s major industry sectors,” said Andy Condon, Director of the Office of Research. “Continuing job growth combined with improving wages appears to be attracting more job seekers into the labor market.” Please visit this link to read the full report: CTDOL NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

26 May 2015

• Conference Board Consumer Confidence Index®— May 2015

|

”The Conference Board Consumer Confidence Index®, which had declined in April, increased moderately in May. The Index now stands at 95.4 (1985=100), up from 94.3 in April… “’Consumer confidence improved modestly in May, after declining sharply in April,’ said Lynn Franco, Director of Economic Indicators at The Conference Board. ‘After a three-month slide, the Present Situation Index increased, propelled by a more positive assessment of the labor market. Expectations, however, were relatively flat following a steep decline in April. While current conditions in the second quarter appear to be improving, consumers still remain cautious about the short-term outlook….’”Please visit this link to read the full report: TheConferenceBoard NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

• U.S. New Residential Sales — April 2015

|

Sales of new single-family houses in April 2015 were at a seasonally adjusted annual rate of 517,000, according to

estimates released 26 May 2015.

This is 6.8 percent (±15.8%) above the revised March rate of 484,000 and is 26.1 percent (±15.4%) above the April

2014 estimate of 410,000.

The median sales price of new houses sold in April 2015 was $297,300; the average sales price was $341,500. The seasonally adjusted estimate of new houses for sale at the end of April was 205,000. This represents a supply of 4.8 months at the current sales rate. Please visit this link to read the full report: USDOC-Census NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

• U.S. Durable Goods Orders, Shipments, & Inventories — April 2015

|

Orders: New orders for manufactured durable goods in April decreased $1.2 billion or 0.5 percent to $235.5 billion. This decrease, down two of the last three months, followed a 5.1 percent March increase. Excluding transportation, new orders increased 0.5 percent. Excluding defense, new orders increased 0.2 percent. Shipments: Shipments of manufactured durable goods in April, down three of the last four months, decreased $0.1 billion or 0.1 percent to $240.5 billion. This followed a 1.5 percent March increase.Inventories: Inventories of manufactured durable goods in April, up twenty-four of the last twenty-five months, increased $0.9 billion or 0.2 percent to $401.5 billion. This was at the highest level since the series was first published on a NAICS basis in 1992 and followed a virtually unchanged March increase. Please visit this link to read the full report: USDOC-Census NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

• “ERISA Fiduciaries have Ongoing Duty to Monitor Trust Investments, U.S. Supreme Court Rules”

|

”Plan fiduciaries have a continuing duty to monitor investments offered under a 401(k) plan, the U.S. Supreme Court has ruled in a unanimous decision. Tibble v. Edison International, No. 13-550 (May 18, 2015).”

Please visit this link to read the full report: JacksonLewis.com NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

• U.S. Employers Suffer Largest Talent Shortage In Skilled Trades

|

”ManpowerGroup's annual Talent Shortage Survey, reveals that 32% of United States employers report difficulties filling job vacancies due to talent shortages. This marks a decrease of 8%, falling from 40% in 2014. ”Globally, the percentage of employers experiencing difficulties continued to rise, increasing from 36% in 2014 to 38% in 2015….”Please visit this link to read the full report: HR.BLR.com NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

• Connecticut: “Qualified Workers A Hard Find For Manufacturers”

|

“Manufacturers in the state continue to have difficulty finding qualified workers, and see overhead costs as the significant threat to sales growth, a new industry survey says. ”More than three-quarters, or 77 percent, of those surveyed see "a lack of qualified candidates" as the main barrier to hiring the optimal number of workers, according to the Manufacturing Alliance of Connecticut's third annual Connecticut Manufacturing Industry Survey. Meanwhile, 70 percent consider "special skills needed" as another major obstacle.”Please visit this link to read the full report: Rep-Am.com NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

22 May 2015

• U.S. Real Earnings – April 2015

|

For the Month: Real average hourly earnings for all employees were unchanged from March to April, seasonally adjusted. This result stems from a 0.1-percent increase in average hourly earnings being offset by a 0.1-percent increase in the Consumer Price Index for All Urban Consumers (CPI-U). Real average weekly earnings were unchanged over the month due to no change in both real average hourly earnings and the average workweek.Last 12 Months: Real average hourly earnings increased by 2.3 percent, seasonally adjusted, from April 2014 to April 2015. This increase in real average hourly earnings, combined with no change in the average workweek, resulted in a 2.3-percent increase in real average weekly earnings over this period. Please visit this link to read the full report: USDOL-BLS *Note: Real earnings show the effect of inflation on your pay. If your salary went up by 2.1% over the year while the cost-of-living (CPI-U) rose 2.3%, then the “real” value of your salary fell by 0.2% [differences in some of the data are due to rounding and seasonal adjustment]. The figures reported here are earnings for all employees on private nonfarm payrolls, seasonally adjusted. NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

• U.S. Consumer Price Index — April 2015

|

The Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.2 percent over the last 12 months to an index level of 236.599 (1982-84=100). For the month, the index rose 0.2 percent prior to seasonal adjustment. The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) decreased 0.8 percent over the last 12 months to an index level of 231.520 (1982-84=100). For the month, the index rose 0.2 percent prior to seasonal adjustment.The Chained Consumer Price Index for All Urban Consumers (C-CPI-U) decreased 0.6 percent over the last 12 months to an index level of 135.019. For the month, the index rose 0.2 percent on a not seasonally adjusted basis. Please note that the indexes for the past 10 to 12 months are subject to revision. The Consumer Price Index for May 2015 is scheduled to be released on Thursday, June 18, 2015, at 8:30 a.m. (EDT).Please visit this link to read the full report: USDOL-BLS NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

21 May 2015

• U.S. Labor Force Characteristics of Foreign-born Workers — 2014

|

In 2014, there were 25.7 million foreign-born persons in the U.S. labor force, comprising 16.5 percent of the total. Hispanics accounted for 48.3 percent of the foreign-born labor force in 2014 and Asians accounted for 24.1 percent.Foreign-born workers were more likely than native-born workers to be employed in service occupations and less likely to be employed in management, professional, and related occupations and in sales and office occupations. The median usual weekly earnings of foreign-born full-time wage and salary workers were $664 in 2014, compared with $820 for their native-born counterparts. Please visit this link to read the full report: USDOL-BLS NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

• U.S. Leading Economic Indicators — April 2015

|

’The Conference Board Leading Economic Index®(LEI) for the U.S. increased 0.7 percent in April to 122.3 (2010 = 100), following a 0.4 percent increase in March, and a 0.2 percent decline in February. “’April’s sharp increase in the LEI seems to have helped stabilize its slowing trend, suggesting the paltry economic growth in the first quarter may be temporary,’ said Ataman Ozyildirim, Economist at The Conference Board. ‘However, the growth of the LEI does not support a significant strengthening in the economic outlook at this time. The improvement in building permits helped to drive the index up this month, but gains in other components, in particular the financial indicators, have been somewhat more muted.’’ Please visit this link to read the full report: TheConferenceBoard NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

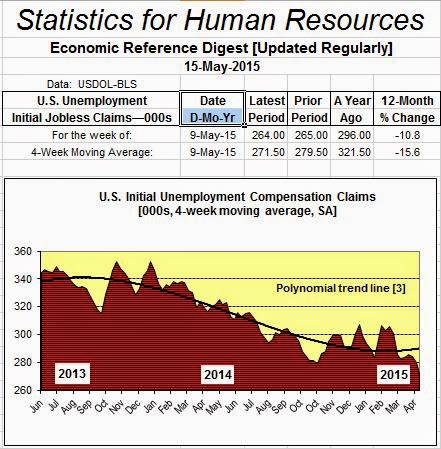

• U.S. Initial Unemployment Claims — 16 May 2015

| In the week ending May 16, the advance figure for seasonally adjusted initial claims was 274,000, an increase of 10,000 from the previous week's unrevised level of 264,000.

The 4-week moving average was 266,250, a decrease of 5,500 from the previous week's unrevised average of 271,750. This is the lowest level for this average since April 15, 2000 when it was 266,250. The advance seasonally adjusted insured unemployment rate was 1.6 percent for the week ending May 9, a decrease of 0.1 percentage point from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending May 9 was 2,211,000, a decrease of 12,000 from the previous week's revised level. The highest insured unemployment rates in the week ending May 2 were in Alaska (3.5), Puerto Rico (2.7), California (2.6), New Jersey (2.6), Connecticut (2.3), Pennsylvania (2.3), Nevada (2.2), West Virginia (2.2), Wyoming (2.2), and Massachusetts (2.1). The largest increases in initial claims for the week ending May 9 were in Georgia (+1,480), Florida (+1,087), South Carolina (+891), Illinois (+860), and North Carolina (+801), while the largest decreases were in New York (-1,696), Oregon (-931), New Hampshire (-726), Wisconsin (-605), and Missouri (-322). Note: “Insured unemployment rate” refers to individuals who are unemployed and receiving UC benefits. See the complete report at this link: USDOL-BLS NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC URL: http://connecticuthumanresources.blogspot.com/ |

20 May 2015

• 383 To Die in Traffic Accidents This Weekend

|

“Memorial Day is May 30 but it is observed on the last Monday in May. It is always a 3.25-day weekend consisting of Friday evening, Saturday, Sunday, and Monday. In 2015, the holiday period extends from 6:00 p.m. Friday, May 22, to 11:59 p.m. Monday, May 25.1

”…the estimate of the number of nonfatal medically consulted injuries that will result from crashes during the holiday period is 46,300 with a range of 39,800 to 53,500. ”…estimate of 383 traffic fatalities from crashes during the holiday period….” Please don’t be a statistic. Please visit this link to read the full article: NationalSafetyCouncil |

19 May 2015

• U.S. Housing Starts, Completions, Building Permits — April 2015

|

BUILDING PERMITS: Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,143,000. This is 10.1 percent (±2.2%) above the revised March rate of 1,038,000 and is 6.4 percent (±2.1%) above the April 2014 estimate of Single-family authorizations in April were at a rate of 666,000; this is 3.7 percent (±0.9%) above the revised March figure of 642,000. Authorizations of units in buildings with five units or more were at a rate of 444,000 in April. HOUSING STARTS: Privately-owned housing starts in April were at a seasonally adjusted annual rate of 1,135,000. This is 20.2 percent (±14.4%) above the revised March estimate of 944,000 and is 9.2 percent (±10.6%) above the April 2014 rate of 1,039,000. Single-family housing starts in April were at a rate of 733,000; this is 16.7 percent (±10.6%) above the revised March figure of 628,000. The April rate for units in buildings with five units or more was 389,000. HOUSING COMPLETIONS: Privately-owned housing completions in April were at a seasonally adjusted annual rate of 986,000. This is 20.4 percent (±14.1%) above the revised March estimate of 819,000 and is 19.4 percent (±15.2%) above the April 2014 rate of 826,000. Single-family housing completions in April were at a rate of 688,000; this is 14.5 percent (±12.4%) above the revised March rate of 601,000. The April rate for units in buildings with five units or more was 288,000. Please visit this link to read the full report: Census.gov NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

15 May 2015

• U.S. Industrial Production and Capacity Utilization — April 2015

|

Industrial production decreased 0.3 percent in April for its fifth consecutive monthly loss. Manufacturing output was unchanged in April after recording an upwardly revised gain of 0.3 percent in March. In April, the index for mining moved down 0.8 percent, its fourth consecutive monthly decrease; a sharp fall in oil and gas well drilling has more than accounted for the overall decline in mining this year. The output of utilities fell 1.3 percent in April. At 105.2 percent of its 2007 average, total industrial production in April was 1.9 percent above its year-earlier level. Capacity utilization for the industrial sector decreased 0.4 percentage point in April to 78.2 percent, a rate that is 1.9 percentage points below its long-run (1972–2014) average. Please visit this link to read the full report: Federal Reserve NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

• U.S. "Engineering Majors Expected to Be Top Earners for the Class of 2015"

|

“Petroleum engineering graduates are expected to come out on top in terms of starting salaries for the Class of 2015, according to a report from the National Association of Colleges and Employers (NACE). The projected median starting salary for bachelor’s degree-level petroleum engineering graduates stands at $93,750. ”Employers providing data for NACE’s January 2015 Salary Survey anticipate offering high starting salaries to a variety of engineering majors. In fact, engineering disciplines account for the report’s top 10 earners." Figure 1: Top 10 Highest Earning Majors – Class of 2015 (Projected Starting Salary) Academic Major Median Starting Salary (Projected) Petroleum Engineering $93,750 Chemical Engineering $66,500 Electrical Engineering $65,000 Nuclear Engineering $65,000 Computer Engineering $63,000 Mechanical Engineering $63,000 Systems Engineering $63,000 Aerospace/Aeronautical Engineering $62,750 Materials Engineering/Science $62,750 Industrial/Manufacturing Engineering $62,500 Please visit this link to read the full report: NACEWeb NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

14 May 2015

• U.S. Initial Unemployment Claims — 09 May 2015

| In the week ending May 9, the advance figure for seasonally adjusted initial claims was 264,000, a decrease of 1,000 from the previous week's unrevised level of 265,000. The 4-week moving average was 271,750, a decrease of 7,750 from the previous week's unrevised average of 279,500. This is the lowest level for this average since April 22, 2000 when it was 266,750.

The advance seasonally adjusted insured unemployment rate was 1.7 percent for the week ending May 2, unchanged from the previous week's unrevised rate. The highest insured unemployment rates in the week ending April 25 were in Alaska (3.6), Puerto Rico (2.8), New Jersey (2.7), Rhode Island (2.6), California (2.5), Connecticut (2.5), the Virgin Islands (2.4), Massachusetts (2.3), Pennsylvania (2.3), Nevada (2.2), West Virginia (2.2), and Illinois (2.1). The largest increases in initial claims for the week ending May 2 were in New York (+810), Oregon (+633), New Hampshire (+515), Pennsylvania (+333), and Virginia (+311), while the largest decreases were in Massachusetts (-4,191), Rhode Island (-2,281), Georgia (-1,801), California (-1,753), and Connecticut (-1,114). Note: “Insured unemployment rate” refers to individuals who are unemployed and receiving UC benefits. See the complete report at this link: USDOL-BLS NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC URL: http://connecticuthumanresources.blogspot.com/ |

• U.S. Producer Price Index — April 2015

|

The Producer Price Index for final demand fell 0.4 percent in April, seasonally adjusted. Final demand prices moved up 0.2 percent in March and decreased 0.5 percent in February. On an unadjusted basis, the index for final demand declined 1.3 percent for the 12 months ended in April.Please visit this link to read the full report: USDOL-BLS NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

12 May 2015

• U.S. Job Openings, Hires, Turnover, Quits — March 2015

|

There were 4.921 million job openings [all data nsa] on the last business day of March, up 17.8% from the same month a year ago; the job openings rate was 3.4%.

Hires were 4.753 million in March, up 7.2% from March 2014; the hires rate was also 3.4%. Total separations were 4.279 million up 11.1% in the last 12 months. This “turnover” rate was 3.0% for the month…an annual equivalent of 36.0%. Within total separations, the 2.496 million quits [up 14.2%] yielded a quit rate of 1.8% percent, and 1.412 million layoffs and discharges [up 6.7%] yielded a rate of 1.0%.[1]The job openings rate is the number of job openings on the last business day of the month as a percent of total employment plus job openings. [2]The hires rate is the number of hires during the entire month as a percent of total employment. [3]The total separations rate is the number of total separations during the entire month as a percent of total employment; includes quits. [4]The quits rate is the number of quits during the entire month as a percent of total employment; included in "total turnover." Please visit this link to read the full report: USDOL-BLS NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

11 May 2015

• Connecticut Drops To 45th In Ranking Of Best States For Business

|

Connecticut is one of the worst states in the nation for business, according to a new survey by Chief Executive magazine. The Nutmeg State ranked 45th out of all 50 states in the 2015 “Best and Worst States for Business” survey, the Greenwich-based publication said Friday in a news release….” Please visit this link to read the full report: ChiefExecutive.net NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

08 May 2015

• U.S. Help-Wanted Advertising — April 2015

|

"Online advertised vacancies decreased 104,500 to 5,361,900 in April, according to The Conference Board Help Wanted OnLine® (HWOL) Data Series, released today. The March Supply/Demand rate stands at 1.57 unemployed for each advertised vacancy, with a total of 3.1 million more unemployed workers than the number of advertised vacancies. The number of unemployed was 8.6 million in March. “’After 8 years, the US Supply/Demand (S/D) rate is now back to its pre-recession best in March 2007,’ said Gad Levanon, Managing Director, Macroeconomic and Labor Market Research. ‘The Great Recession had taken the US S/D rate to a high of about 5.0 in April 2009 (nearly 5 unemployed competing for each ad). This month’s S/D rate shows a little over 1.5 unemployed competing for each ad.’ ”The significant drop in the US S/D rate has been helped by very strong employer demand, ranging from 4 to 5 million ads each month over the past 4 years, making it easier for the recession’s 15 million unemployed to find employment opportunities. With the recession’s unemployment numbers finally down significantly, the continued high employer demand at 5 million ads per month will make the job search for new entrants into the labor market much easier.” Please visit this link to read the full report: The Conference Board NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

• U.S. Employment Situation — April 2015

|

In April, both the unemployment rate (5.4 percent) and the number of unemployed persons (8.5 million) were essentially unchanged. Over the year, the unemployment rate and the number of unemployed persons were down by 0.8 percentage point and 1.1 million, respectively. Among the major worker groups, the unemployment rate for Asians increased to 4.4 percent. The rates for adult men (5.0 percent), adult women (4.9 percent), teenagers (17.1 percent), whites (4.7 percent), blacks (9.6 percent), and Hispanics (6.9 percent) showed little or no change in April. Total nonfarm payroll employment rose by 223,000 in April, after edging up in March (+85,000). In April, employment increased in professional and business services, health care, and construction, while employment in mining continued to decline. The average workweek for all employees on private nonfarm payrolls remained at 34.5 hours in April. The manufacturing workweek for all employees edged down by 0.1 hour to 40.8 hours, and factory overtime edged down by 0.1 hour to 3.2 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls was unchanged at 33.7 hours. In April, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $24.87. Over the past 12 months, average hourly earnings have increased by 2.2 percent. Average hourly earnings of private-sector production and nonsupervisory employees edged up by 2 cents to $20.90 in April. Please visit this link to read the full report: USDOL-BLS NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

07 May 2015

• U.S. Initial Unemployment Claims — 02 May 2015

| In the week ending May 2, the advance figure for seasonally adjusted initial claims was 265,000, an increase of 3,000 from the previous week's unrevised level of 262,000. The 4-week moving average was 279,500, a decrease of 4,250 from the previous week's unrevised average of 283,750. This is the lowest level for this average since May 6, 2000 when it was 279,250. The advance seasonally adjusted insured unemployment rate was 1.7 percent for the week ending April 25, unchanged from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending April 25 was 2,228,000, a decrease of 28,000 from the previous week's revised level.

Note: “Insured unemployment rate” refers to individuals who are unemployed and receiving UC benefits. See the complete report at this link: USDOL-BLS NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC URL: http://connecticuthumanresources.blogspot.com/ |

06 May 2015

• U.S. Productivity Falls 1.9% (Annual Rate); Unit Labor Costs Rise 5.0% — Q1 2015

|

Nonfarm business sector labor productivity decreased at a 1.9 percent annual rate during the first quarter of 2015 as output declined 0.2 percent and hours worked increased 1.7 percent. (All quarterly percent changes in this release are seasonally adjusted annual rates.) The decline in productivity follows a decline of 2.1 percent in the fourth quarter of 2014. From the first quarter of 2014 to the first quarter of 2015, productivity increased 0.6 percent, reflecting increases in output and hours worked of 3.5 percent and 2.9 percent, respectively. Unit labor costs in the nonfarm business sector increased 5.0 percent in the first quarter of 2015, reflecting a 3.1 percent increase in hourly compensation and a 1.9 percent decline in productivity. Unit labor costs increased 1.1 percent over the last four quarters. Please visit this link to read the full report: USDOL-BLS NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

• ADP U.S. National Employment Report — April 2015

|

ADP says that U.S. private-sector employment increased by 169,000 from March to April, on a seasonally adjusted basis. Please visit this link to read the full report: ADP According to ADP, “…the ADP National Employment Report is designed to align with the final revised BLS numbers, and not those that are first reported…. The BLS revises its employment data several times: In the two subsequent months after the initial release…. Because our data is based on actual live payroll data, we believe our number will most closely correlate with – and should be compared with – the final revised BLS numbers when all of the data from the survey respondents has [sic] been incorporated.” NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

05 May 2015

• What Employers Can Do to Protect Employees from Heat-Related Illness— Spring 2015

|

”As a cold winter finally comes to an end, many of us look forward to summertime warmth. But sun and heat can spell danger for workers who are exposed to soaring temperatures and a rising heat index. ”According to the Occupational Safety and Health Administration (“OSHA”), thousands of workers in the United States get sick from excessive heat exposure while working outdoors each year and more than 30 workers died in 2012 from heat-related illnesses….”Please visit this link to read the full report: JacksonLewis.com NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

04 May 2015

• U.S. IT Salary Survey — 2015

|

”After several years of slow gains, we're seeing notable compensation increases for IT pros in a range of positions. Average total compensation (salary plus bonus) increased 3.6% in 2015, compared to an average of 2% in the three preceding years. ”And those raises are spread among more respondents: 67% of 2015 respondents report receiving a salary increase, compared with 60% in 2014, 57% in 2013 and just 47% in 2012….” Please visit this link to read the full report: Computerworld NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |

01 May 2015

• Survey: U.S. “Employee Confidence at An All-Time High Despite Weak Employment Gains” — Q1 2015

|

“The Randstad Employee Confidence Index (ECI) reached 62.3 in the first quarter 2015, the highest figure reported since the survey's inception in the third quarter of 2004.

”The ECI, which is calculated from the results of an online survey, measures employed workers' perceptions regarding the overall strength of the economy, availability of jobs, confidence in current employer, and their ability to find a new job….” Please visit this link to read the full report: HR.BLR.com NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. © 2015 Connecticut Human Resource Reports, LLC |