| State personal income growth accelerated to 1.5 percent in the second quarter of 2014 from 1.2 percent in the first quarter.

Personal income growth ranged from 2.7 percent in North Dakota and Nebraska to 1.1 percent in New York and Alaska, with growth accelerating in 36 states. Inflation, as measured by the national price index for personal consumption expenditures, accelerated to 0.6 percent in the second quarter from 0.3 percent in the first quarter. Click on photo to enlarge Please visit this link to read the full report: USDOC-BEA NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. |

30 September 2014

• U.S. Personal Income By State – Q2 2014

• U.S. Online Help-Wanted Advertising – August 2014

| "Online advertised vacancies gained 164,600 to 5,209,200 in August, according to The

Conference Board Help Wanted OnLine® (HWOL) Data Series."

Click on table/chart to enlarge ”The July Supply/Demand rate stands at 1.9 unemployed for each advertised vacancy with a total of 4.6 million more unemployed workers than the number of advertised vacancies. “’Labor demand has shown some renewed strength over the past three months with an average increase of 102,000 per month,’ said Gad Levanon, Director of Macroeconomics and Labor Markets at The Conference Board. ‘The 2014 gains through August are an improvement over the slower-paced gains of 2013 for the same time period.’ ”In August the professional occupations continued to show improvements after earlier 2014 losses. Gains included Business and Finance (10,700), Computer and Math (19,300), and Healthcare (24,200). The Services/Production occupations also showed gains in Office and Administration (20,100), Sales (13,900), and Food Preparation (12,300).” See the complete report at this link: The Conference Board NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. |

29 September 2014

• U.S. Regular Gasoline Prices – August 2014

|

Click on table/chart to enlarge Data: U.S. Department of Energy NOTE: This report is provided with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. |

• U.S. Payrolls – August 2014

| Private wages and salaries increased $30.4 billion in August, compared with an increase of $17.4 billion in July.

Click on table to enlarge Goods-producing industries' payrolls increased $6.0 billion, compared with an increase of $1.2 billion; manufacturing payrolls increased $3.6 billion, in contrast to a decrease of $0.8 billion. Services-producing industries' payrolls increased $24.6 billion, compared with an increase of $16.2 billion. Government wages and salaries increased $1.4 billion, compared with an increase of $1.1 billion. See the complete report at this link: USDOC-BEA NOTE: This report is published with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. |

• U.S. Personal Income – August 2014

| Personal income increased $47.3 billion, or 0.3 percent, and disposable personal income (DPI) increased $35.2 billion,

or 0.3 percent, in August. Personal consumption expenditures (PCE)

increased $57.5 billion, or 0.5 percent.

Click on table/chart to enlarge

In July, personal income increased $35.9 billion, or 0.2 percent, DPI increased $24.6 billion, or 0.2 percent, and PCE increased $0.5 billion, or less than 0.1 percent, based on revised estimates. Real DPI increased 0.3 percent in August, compared with an increase of 0.1 percent in July. Real PCE increased 0.5 percent, in contrast to a decrease of 0.1 percent. See the complete report at this link: USDOC-BEA NOTE: This report is published with the understanding that the publisher is not engaged in providing legal, financial, accounting or other professional advice. If professional assistance is required, the services of a competent professional should be sought. Furthermore, while we do our best to ensure that these data are accurate, we suggest that any entity making decisions based on these numbers should verify the data at their source prior to making such decisions. |

26 September 2014

• U.S. Real GDP – Q2 2014 [Third Estimate]

| Real gross domestic product -- the output of goods and services produced by labor and property

located in the United States -- increased at an annual rate of 4.6 percent in the second quarter of 2014,

according to the "third" estimate. In the first quarter, real

GDP decreased 2.1 percent.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 4.2 percent. With the third estimate for the second quarter, the general picture of economic growth remains the same; increases in nonresidential fixed investment and in exports were larger than previously estimated. The increase in real GDP in the second quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, private inventory investment, nonresidential fixed investment, state and local government spending, and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased. Real GDP increased 4.6 percent in the second quarter, after decreasing 2.1 percent in the first. This upturn in the percent change in real GDP primarily reflected upturns in exports and in private inventory investment, accelerations in nonresidential fixed investment and in PCE, and upturns in state and local government spending and in residential fixed investment that were partly offset by an acceleration in imports. See the complete report at this link: USDOC-BEA |

25 September 2014

• Connecticut’s Annual Revision of Unemployment Insurance Rate Puts Maximum Benefit at $594

|

The annual revision of the Unemployment Insurance benefit rate will result in claimants receiving a maximum amount of $594 per week, effective October 5, 2014.

The revised rate is four dollars more than the current $590 weekly maximum rate, and will apply to claims filed for the benefit years starting on and after October 5, 2014. Those who filed a claim prior to this date and have been collecting unemployment benefits will be unaffected by this revision. The weekly dependency allowance for each dependent of $15 with a maximum of $75 remains unchanged. See the complete report at this link: CTDOL |

• U.S. Initial Unemployment Claims – 20 September 2014

| In the week ending September 20, the advance figure for seasonally adjusted initial claims was 293,000, an increase of

12,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 280,000 to

281,000. The 4-week moving average was 298,500, a decrease of 1,250 from the previous week's revised average. The

previous week's average was revised up by 250 from 299,500 to 299,750. Click on chart to enlarge: The advance seasonally adjusted insured unemployment rate was 1.8 percent for the week ending September 13, unchanged from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending September 13 was 2,439,000, an increase of 7,000 from the previous week's revised level. The highest insured unemployment rates in the week ending September 6 were in Puerto Rico (3.6), New Jersey (3.0), Alaska (2.9), Connecticut (2.5), California (2.4), Nevada (2.4), Pennsylvania (2.3), Virgin Islands (2.3), Massachusetts (2.2), District of Columbia (2.0), Illinois (2.0), and New York (2.0). The largest increases in initial claims for the week ending September 13 were in California (+5,269), Missouri (+1,810), Oregon (+1,691), New York (+810), and Florida (+777), while the largest decreases were in Michigan (-2,473), New Jersey (-1,573), Nebraska (-916), Kansas (-657), and Illinois (-638). Note: “Insured unemployment rate” refers to individuals who are unemployed and receiving UC benefits. See the complete report at this link: USDOL-BLS |

19 September 2014

• Connecticut’s Employment Situation – August 2014

| August 2014 initial nonfarm employment estimates decreased 3,600 (-0.2%) positions to 1,665,300 jobs

(seasonally adjusted). This is the first total nonfarm employment decline in seven months after six straight monthly nonfarm job gains coming out of the January 2014 deep freeze. See the complete report at this link: CTDOL |

• Regional and State Employment and Unemployment - August 2014

| Unemployment: Regional and state unemployment rates were generally little changed in August.

Twenty-four states and the District of Columbia had unemployment rate increases

from July, 15 states had decreases, and 11 states had no change.

Forty-five states and the District of Columbia had unemployment rate decreases from a year earlier, three states had increases, and two states had no change. The national jobless rate was little changed from July at 6.1 percent but was 1.1 percentage points lower than in August 2013. Employment: Nonfarm payroll employment increased in 35 states and decreased in 15 states and the District of Columbia. The largest over-the-month percentage increase in employment occurred in New Mexico (+0.6 percent), followed by Nebraska (+0.5 percent) and Alabama and Georgia (+0.4 percent each). The largest over-the-month percentage decline in employment occurred in New Hampshire (-0.7 percent), followed by the District of Columbia and Idaho (-0.6 percent each). Over the year, nonfarm employment increased in 49 states and the District of Columbia and decreased in Alaska (-0.8 percent). The largest over-the-year percentage increase occurred in North Dakota (+4.4 percent), followed by Nevada, Texas, and Utah (+3.5 percent each). See the complete report at this link: USDOL-BLS |

18 September 2014

• U.S. Employee Job Tenure - 2014

| In January 2014, median employee tenure (the point at which half of all workers

had more tenure and half had less tenure) for men was 4.7 years, unchanged from

January 2012. For women, median tenure in January 2014 was 4.5 years, about the same as January 2012. Among men, 30 percent of wage and salary workers had 10 years or more of tenure with their current employer, compared with 28 percent for women. Median employee tenure was generally higher among older workers than younger ones. For example, the median tenure of workers ages 55 to 64 (10.4 years) was more than three times that of workers ages 25 to 34 years (3.0 years)…. See the complete report at this link: USDOL-BLS |

• U.S. Employment & Wages By County – Q1 2014

| From March 2013 to March 2014, employment increased in 281 of the 339 largest U.S. counties.. Weld, Colo., had the largest increase, with a gain of 7.5

percent over the year, compared with national job growth of 1.7 percent. Peoria, Ill., had the largest over-the-year decrease in employment among the largest

counties in the U.S. with a loss of 2.6 percent.

The U.S. average weekly wage increased 3.8 percent over the year, growing to $1,027 in the first quarter of 2014. Chester, Pa., had the largest over-the-year increase in average weekly wages with a gain of 13.9 percent. Benton, Ark., experienced the largest decrease in average weekly wages with a loss of 3.2 percent over the year. See the complete report at this link: USDOL-BLS |

• Survey: 2015 Merit Budgets: 3%

| “The new Towers Watson Data Services Salary Budget Survey found that U.S. employers are planning to give pay raises that will average 3 percent in 2015 for their exempt nonmanagement (e.g., professional) employees.

”That is only slightly larger than the average 2.9 percent increase workers received in each of the past 2 years." See the complete report at this link: BLR.Com |

• U.S. Real Wages – August 2014

| Real average hourly earnings for all employees increased by 0.4 percent from July to August, seasonally

adjusted. This increase stems from a 0.2 percent

increase in the average hourly earnings and a 0.2 percent decrease in the Consumer Price Index for All

Urban Consumers (CPI-U). The change in real average hourly earnings is the largest 1-month percentage

increase since November 2012.

Real average weekly earnings increased by 0.4 percent over the month due to the increase in real average hourly earnings and an unchanged average workweek. Real average hourly earnings increased 0.4 percent, seasonally adjusted, from August 2013 to August 2014. The increase in real average hourly earnings, combined with an unchanged average workweek, resulted in a 0.4 percent increase in real average weekly earnings over this period. See the complete report at this link: USDOL-BLS |

• U.S. Consumer Price Index – August 2014

| The Consumer Price Index for All Urban Consumers (CPI-U) increased 1.7 percent

over the last 12 months to an index level of 237.852 (1982-84=100). For the

month, the index fell 0.2 percent prior to seasonal adjustment.

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.6 percent over the last 12 months to an index level of 234.030 (1982-84=100). For the month, the index fell 0.2 percent prior to seasonal adjustment. The Chained Consumer Price Index for All Urban Consumers (C-CPI-U) increased 1.5 percent over the last 12 months. For the month, the index fell 0.2 percent on a not seasonally adjusted basis. Please note that the indexes for the post-2012 period are subject to revision. The Consumer Price Index for September 2014 is scheduled to be released on Wednesday, October 22, 2014, at 8:30 a.m. (EDT). See the complete report at this link: USDOL-BLS |

• U.S. Initial Unemployment Claims – 13 September 2014

| In the week ending September 13, the advance figure for seasonally adjusted initial claims was 280,000, a decrease of

36,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 315,000 to

316,000. The 4-week moving average was 299,500, a decrease of 4,750 from the previous week's revised average. The previous week's average was revised up by 250 from 304,000 to 304,250. There were no special factors impacting this week's initial claims. The advance seasonally adjusted insured unemployment rate was 1.8 percent for the week ending September 6, a decrease of 0.1 percentage point from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending September 6 was 2,429,000, a decrease of 63,000 from the previous week's revised level. The highest insured unemployment rates in the week ending August 30 were in Puerto Rico (3.9), New Jersey (3.3), Alaska (3.0), Connecticut (2.7), Pennsylvania (2.5), California (2.3), Massachusetts (2.3), New York (2.2), Nevada (2.1), Rhode Island (2.1), Virgin Islands (2.1), and District of Columbia (2.0). The largest increases in initial claims for the week ending September 6 were in New Jersey (+2,918), Illinois (+912), Nebraska (+877), Kansas (+670), and Tennessee (+651), while the largest decreases were in California (-10,968), New York (-2,811), Michigan (-1,117), Pennsylvania (-860), and Oregon (-740). Click on chart to enlarge Note: “Insured unemployment rate” refers to individuals who are unemployed and receiving UC benefits. See the complete report at this link: USDOL-BLS |

16 September 2014

• U.S. Producer Price Index – August 2014

| The Producer Price Index for final demand was unchanged in August. Final demand prices advanced 0.1 percent in July and 0.4 percent in June.

In August, a 0.3-percent rise in prices for final demand services offset a 0.3-percent decrease in the index for final demand goods. See the complete report at this link: USDOL-BLS |

11 September 2014

• U.S. Census of Fatal Occupational Injuries Summary - 2013

| A preliminary total of 4,405 fatal work injuries were recorded in the United States in 2013, lower than the revised

count of 4,628 fatal work injuries in 2012, according to results from the Census of Fatal Occupational

Injuries conducted by the U.S. Bureau of Labor Statistics.

The rate of fatal work injury for U.S. workers in 2013 was 3.2 per 100,000 full-time equivalent workers, compared to a final rate of 3.4 per 100,000 in 2012. See the complete report at this link: USDOL-BLS |

• U.S. Initial Unemployment Claims – 06 September 2014

| In the week ending September 6, the advance figure for seasonally adjusted initial claims was 315,000, an increase of

11,000 from the previous week's revised level and up 2.6% from the same week a year ago. The previous week's level was revised up by 2,000 from 302,000 to

304,000.

The 4-week moving average was 304,000, an increase of 750 from the previous week's revised average. The previous week's average was revised up by 500 from 302,750 to 303,250. The advance seasonally adjusted insured unemployment rate was 1.9 percent for the week ending August 30, unchanged from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending August 30 was 2,487,000, an increase of 9,000 from the previous week's revised level. The highest insured unemployment rates in the week ending August 23 were in Puerto Rico (3.9), New Jersey (3.3), Connecticut (3.0), Alaska (2.9), California (2.6), Pennsylvania (2.6), Massachusetts (2.5), Rhode Island (2.5), Virgin Islands (2.4), Illinois (2.2), Nevada (2.2), and New York (2.2). The largest increases in initial claims for the week ending August 30 were in California (+1,563), New York (+1,254), Iowa (+579), Wisconsin (+412), and Pennsylvania (+362), while the largest decreases were in New Jersey (-901), Illinois (-633), Georgia (-465), Massachusetts (-345), and Kentucky (-324). Note: “Insured unemployment rate” refers to individuals who are unemployed and receiving UC benefits. See the complete report at this link: USDOL-BLS |

10 September 2014

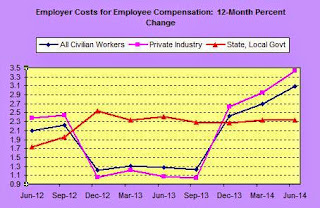

• Employer Costs For Employee Compensation – June 2014

| Private industry employers spent an average of $30.11 per hour worked for employee compensation in

June 2014. Wages and salaries averaged $21.02 per

hour worked and accounted for 69.8 percent of these costs, while benefits averaged $9.09 and accounted

for the remaining 30.2 percent.

Total compensation costs for state and local government workers averaged $43.07 per hour worked in June 2014. Total compensation costs for civilian workers, which include private industry and state and local government workers, averaged $31.96 per hour worked in June 2014. See the complete report at this link: USDOL-BLS |

09 September 2014

• U.S. Job Openings, Hires, and Labor Turnover – July 2014

| There were 4.7 million job openings on the last business day of July and the rate was 3.3 percent. The

1-month change in the number of openings was not significant for total private, government, all

industries, and in all four regions.

Although the number of total nonfarm job openings was little changed in July, there were 799,000 more job openings in July than in January 2014. The largest increases since January were in retail trade, professional and business services, and health care and social assistance. See the complete report at this link: USDOL-BLS Click on chart to enlarge. |

08 September 2014

• Class of 2014 Grad Starting Salaries Climb 7.5%

|

“The overall average starting salary for Class of 2014 college graduates stands at $48,707, up 7.5 percent from the average of $45,327 posted by the Class of 2013 at this time last year, according to a new report by the National Association of Colleges and Employers (NACE).

”An executive summary of the September 2014 Salary Survey report is available at www.naceweb.org/salary-resources/salary-survey.aspx. "The final Salary Survey report for Class of 2014 graduates will be published in January 2015. See the press release at this link: NACE |

05 September 2014

• U.S. Employment Situation – August 2014

| In August, both the unemployment rate (6.1 percent) and the number of unemployed

persons (9.6 million) changed little. Over the year, the unemployment rate and

the number of unemployed persons were down by 1.1 percentage points and 1.7 million,

respectively.

Among the major worker groups, the unemployment rates in August showed little or no change for adult men (5.7 percent), adult women (5.7 percent), teenagers (19.6 percent), whites (5.3 percent), blacks (11.4 percent), and Hispanics (7.5 percent). The jobless rate for Asians was 4.5 percent (not seasonally adjusted), little changed from a year earlier. See the complete report at this link: USDOL-BLS |

04 September 2014

• U.S. Productivity and Unit Labor Costs – Q2 2014

| Productivity increased 2.3 percent in the nonfarm business sector in the second quarter of 2014; unit labor costs decreased 0.1 percent (seasonally adjusted annual rates).

In manufacturing, productivity increased 3.3 percent and unit labor costs decreased 1.6 percent. See the complete report at this link: USDOL-BLS |

• U.S. Initial Unemployment Claims – 30 August 2014

| In the week ending August 30, the advance figure for seasonally adjusted initial claims was 302,000, an increase of

4,000 from the previous week's unrevised level of 298,000. The 4-week moving average was 302,750, an increase of

3,000 from the previous week's unrevised average of 299,750.

The advance seasonally adjusted insured unemployment rate was 1.9 percent for the week ending August 23, unchanged from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending August 23 was 2,464,000, a decrease of 64,000 from the previous week's revised level. The highest insured unemployment rates in the week ending August 16 were in Puerto Rico (4.0), New Jersey (3.3), Alaska (3.1), Connecticut (3.1), Pennsylvania (2.8), California (2.7), Rhode Island (2.7), Massachusetts (2.5), and Nevada (2.5). The largest increases in initial claims for the week ending August 23 were in New York (+2,560), Michigan (+1,845), California (+867), Illinois (+613), and Texas (+308), while the largest decreases were in Georgia (-1,369), Massachusetts (-1,283), Pennsylvania (-1,031), Iowa (-1,016), and Alabama (-689). Note: “Insured unemployment rate” refers to individuals who are unemployed and receiving UC benefits. See the complete report at this link: USDOL-BLS |